Invoice programs for small businesses can make a tangible difference in how quickly you get paid and how efficiently you track your revenue. Instead of juggling spreadsheets or manual templates, the best invoice programs automate key tasks, such as recurring billing, reminders, and payment processing—helping you maintain accuracy and save valuable time.

In this article, we help you discover the best invoice program for small businesses and how online faxing complements an invoicing software.

Table of contents

Why Small Businesses Need Invoice Software

An invoice is more than a receipt. It’s a record of cash flow, accountability, and professionalism. For small businesses, managing invoices manually can lead to late payments, missed entries, or inconsistent documentation. Invoice software eliminates these pain points by centralizing all billing activities within a single system.

With automated invoicing, you can:

- Issue invoices faster. Generate and send professional invoices in minutes using pre-built templates.

- Reduce errors. Automation minimizes calculation mistakes and duplicate records.

- Improve payment turnaround. Auto-reminders and online payment links encourage clients to make timely payments.

- Stay organized. Every transaction is logged and searchable, helping you maintain a clear audit trail for accounting or compliance purposes.

- Project professionalism. A clean, branded invoice strengthens client trust and presents your business as organized and credible.

For a small team with limited resources, the right invoicing solution simplifies billing while giving you control and visibility over your financial health.

The Best Invoice Programs for Small Business

Here are some of the most trusted invoice programs that combine affordability, simplicity, and reliability for small business operations:

QuickBooks Online

A leading choice for accounting and finance management, QuickBooks Online integrates invoicing directly with bookkeeping. It allows you to track invoices, reconcile payments, and generate detailed financial reports. Features like recurring invoices, payment reminders, and integration with bank feeds make it ideal for growing businesses that need both billing and accounting in one place.

FreshBooks

FreshBooks is tailored for service-based professionals who bill clients by project or time. It includes built-in time tracking, expense logging, and invoice customization tools. Clients can view invoices and make payments online, while you can monitor outstanding balances and send reminders automatically.

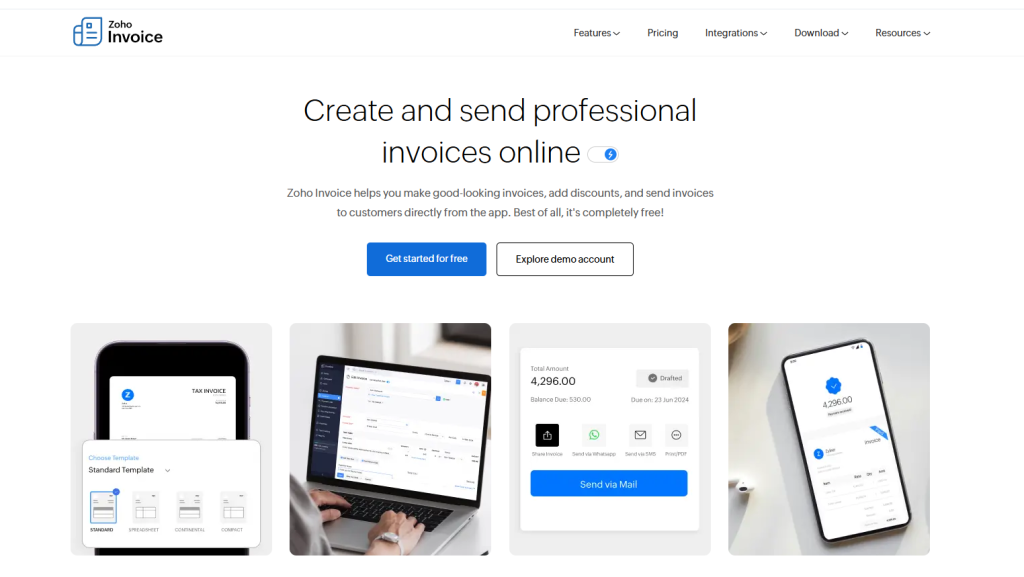

Zoho Invoice

Zoho Invoice stands out as a free, fully functional invoicing platform—perfect for startups or freelancers on a budget. It supports multi-currency billing, recurring invoices, and client portals. Its integration with other Zoho business apps (like CRM or Books) provides a seamless workflow for those using the broader Zoho ecosystem.

Wave

Wave is another excellent free option that combines invoicing and accounting. It’s best suited for freelancers or small business owners handling a low to moderate number of invoices per month. Wave supports unlimited clients and invoices, with optional paid add-ons for online payment processing.

Invoice Ninja

Invoice Ninja is a flexible open-source invoicing solution that gives users control over customization. It offers proposals, quotes, task tracking, and time billing, alongside recurring invoices and payment reminders. Its open-source nature makes it highly adaptable for tech-savvy small business owners.

Invoice2go

If mobility matters, Invoice2go offers a mobile-first design that makes invoicing on the go simple. Users can create invoices, accept payments, and view reports directly from their smartphones. Its clean interface and robust mobile experience make it a favorite among contractors and independent service providers.

Each of these tools has its strengths. The best one for your small business depends on your billing volume, client type, and whether you need built-in accounting or prefer a standalone invoicing solution.

Key Features To Look for in an Invoice Program

Choosing the right invoice software starts with knowing which features truly make a difference to your workflow. Here are some essential capabilities to prioritize:

- Customizable templates: Ensure invoices align with your brand identity while maintaining clarity and compliance.

- Automated reminders and recurring billing: Reduce manual follow-ups for repeat clients or subscription-based services.

- Online payment integration: Accepting payments directly from an invoice improves turnaround time.

- Multi-currency and tax handling: A must-have for businesses with international clients.

- Reporting and analytics: Insightful dashboards help you track overdue invoices, top-paying clients, and overall cash flow.

- Mobile access: Enables you to issue or approve invoices from any device, anywhere.

- Security and data protection: Since invoices include sensitive client and financial information, encryption and secure backups are essential.

- Integration options: Seamless compatibility with accounting, CRM, and communication tools ensures your billing fits naturally within your existing tech stack.

A good invoice program should not only simplify billing; it should also streamline the entire process. It should integrate seamlessly with your broader workflow, enabling faster decision-making and reducing administrative bottlenecks.

How iFax Complements Your Invoicing Software

While digital invoicing has become the standard, specific sectors—such as healthcare, legal, and government—still rely on faxed documents for contracts, authorizations, and payment verification. iFax enhances your invoicing workflow by enabling you to send invoices securely via fax, directly from tools such as QuickBooks, Zoho, or FreshBooks.

With enterprise-grade encryption and compliance with HIPAA, GLBA, and SOC 2 standards, iFax ensures your financial data remains fully protected during transmission. Beyond security, iFax helps maintain a verifiable audit trail with delivery confirmations and detailed fax logs, providing proof of transmission for accounting or compliance purposes. Its seamless integrations with Google Workspace, Microsoft 365, and popular cloud platforms make it easy to fax invoices without disrupting your workflow.

Whether you’re sending one invoice or hundreds, iFax’s bulk faxing feature handles the process efficiently—bridging the gap between modern invoicing software and traditional fax communication.

The best invoicing program for small businesses should be convenient, accurate, efficient, and transparent throughout the entire billing process. Tools like QuickBooks, FreshBooks, and Zoho Invoice simplify day-to-day invoicing, while iFax ensures your documents reach every client securely, even when fax is still required.

Check out iFax today and see how secure online faxing complements your invoicing workflow.