Faxing crucial documents can be stressful and time-consuming, especially when dealing with financial matters. Filing Form 8886 is no exception, and ensuring your copy is sent securely and arrives on time is crucial.

In this article, we’ll explore the ins and outs of online faxing IRS Form 8886 to the IRS and provide tips on guaranteeing a smooth and stress-free experience. Whether you’re a seasoned tax pro or a first-time filer, this guide is essential for anyone looking to send a fax to the IRS.

What Is IRS Form 8886?

What Is IRS Form 8886?

Before we begin, we must first define the form in question. Only specific businesses that fit several criteria deal with this document when tax season comes around.

Who should be filing IRS Form 8866?

IRS Form 8886, also known as the “Reportable Transaction Disclosure Statement,” is a tax form used to report certain types of transactions that may have a potential for tax avoidance or evasion. This form applies to individuals, partnerships, trusts, S corporations, and other corporations participating in a reportable transaction.

The IRS (Internal Revenue Service) considers reportable transactions as having the potential for tax avoidance or evasion. These transactions may not be consistent with customary economic and business purposes and have tax benefits not intended for use according to tax laws.

Examples of reportable transactions include:

- Tax shelters

- Reportable contract sales

- Certain corporate acquisitions

- Transactions involving foreign trusts

- Transactions involving property transfer to a partnership in exchange for a partnership interest.

Taxpayers must determine if a transaction is reportable and appropriately file IRS Form 8886 to disclose it to the IRS.

When should businesses file this form?

Covered businesses should file Form 8886 by the due date of the year’s tax return in which the reportable transaction occurred, including extensions. Failure to file Form 8886 or to disclose a reportable transaction can result in penalties, fines, and interest charges.

Why would you need to file Form 8886?

Form 8886 provides the IRS with information about transactions that may have tax implications. This data helps the IRS identify transactions that may not comply with tax laws and regulations. It also helps the government monitor and enforce compliance with these laws.

In summary, filing Form 8886 is essential for entities participating in reportable transactions. Filing the form by the due date of the tax return helps ensure compliance with tax laws and regulations and can help avoid potential penalties and fines.

Guide to Sending IRS Form 8868 via Fax

Sending Form 8886 to the IRS can be straightforward, especially when using an online fax service. Here’s a step-by-step guide on how to send the form to the IRS using online fax:

Prepare the form

Make sure your copy is complete and accurate before you send it. Double-check that you have filled in all the required information, and sign the form where necessary.

Scan or digitally upload the form

If you have a hard copy, scan it or take a picture. If you have the document on your computer, upload it to the online fax service.

Choose your fax service

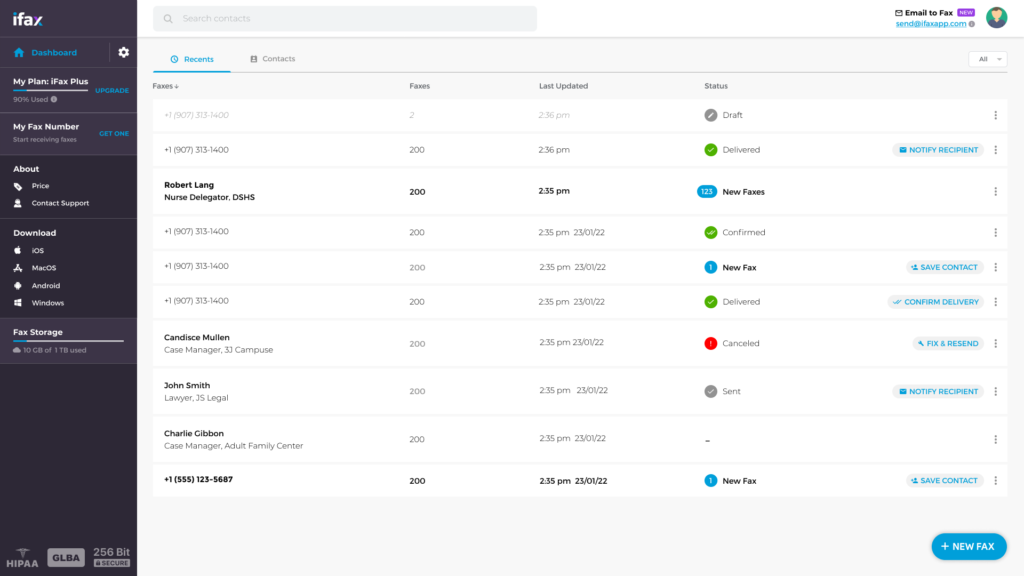

Select an online service that meets your needs and has a good reputation. iFax is the top choice for many businesses of all sizes and scales. It’s known for its intuitive platform, powerful features, and secure fax transmissions.

Create an iFax account

Sign up for iFax through our website or log in if you have an existing account. You will need to provide basic information and choose a username and password.

Enter the IRS form fax number

Enter the IRS form fax number

You can find the specific fax number for this IRS form on their government website. Enter the number into the “To” field in the online fax service.

Attach the form

Attach the scanned or uploaded Form 8886 to the online fax, just as you would attach a file to an email.

Send the fax

Click the “Send” button to send the fax to the IRS. Some online fax services provide in-app confirmation that the fax was sent successfully, while others will send you an email notification.

Keep records

Make sure you keep a copy of the form and the confirmation of faxing for your reference. This paper trail will help your business comply with financial regulations.

As we’ve illustrated, you can send Form 8886 to the IRS quickly, securely, and easily using an online fax service. Say goodbye to waiting in line at the post office or worrying about paper jams in the office fax machine. With online fax, you can send your forms from the comfort of your own home or office.

Faxing IRS Form 8886 Effortlessly With iFax

iFax streamlines communication and saves businesses time and money. With our user-friendly interface, robust security features, and integration with popular cloud services, it’s no wonder that iFax has become a go-to solution for businesses of all types, especially during tax season.

iFax helps taxpayers free up time and reduce worries each year by streamlining the tax form filing process. Apart from the form we’ve covered, you can file most IRS tax forms using iFax. It’s quick, convenient, and powerful.

Whether you’re sending a quick fax or need to send hundreds in a day, iFax offers a reliable and efficient solution. Sign up for iFax today and experience the benefits of online faxing.